AGENDA

- All Topics

- CHATHAM HOUSE ROUNDTABLE SESSIONS

- MAIN STAGE - GEO SPOTLIGHT

- MAIN STAGE - LIGHTNING TALKS

- MEETINGS

- NETWORKING

- REGISTRATION

26 APRIL- SUNDAY

- 18:00 - 20:00

REGISTRATION

- 18:00 - 19:30

OFFICIAL WELCOME DRINKS RECEPTION

Admission to Badge Holders only

NETWORKINGWhereAtlantis Royal Terrace

27 APRIL - MONDAY

- 07:45 - 18:00

REGISTRATION

- 08:00 - 18:30

Meetings

- 09:00 - 09:45

The Future of the DIFC

A keynote and panel discussion exploring the Dubai International Financial Centre’s evolving role in global reinsurance, and an update on plans for 2026. The DIFC & members will assess regulatory developments, market expansion, and DIFC’s ambitions as a hub for innovation, MGAs, attracting new capacity, and capital flows across the MEASA region.

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom  10:00 - 10:30

10:00 - 10:30AI in Reinsurance: Transforming Claims and Underwriting

By HE RAJA AL MAZROUEI Chief Executive Officer, Etihad Credit InsuranceExperts will examine how artificial intelligence is reshaping the reinsurance value chain from claims automation and underwriting analytics to generative AI applications. The session will also consider how technology is changing workforce dynamics and skill sets across the industry. Hiring processes have changed as a result of AI and we’ll explore how that will change the landscape of talent.

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom- 10:45 - 11:15

Climate Change and Risk Resilience

This session addresses the reinsurance response to a changing climate, covering catastrophe modelling & resilience financing. Panellists will discuss data innovation, new modelling approaches, and strategies for managing the growing protection gap amid more frequent extreme weather events.

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom - 12:00 - 12:45

DIFC Roundtable

A focused conversation following on from the DIFC keynote. The session will discuss on the Dubai International Financial Centre’s evolving role as a regional and international hub for reinsurance. Senior market figures will exchange views on regulatory developments, capital flows, and strategic priorities driving the DIFC’s continued growth and global relevance.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 13:00 - 13:30

Lunch 1

- 13:30 - 14:00

Lunch 2

- 14:00 - 15:00

Lunch 3

- 15:00 - 15:45

AI Roundtable

An engaging, participant-driven discussion on the most practical and high-impact AI applications in reinsurance. Delegates will debate real-world use cases in claims, underwriting, pricing, and portfolio management, exploring both successes and pitfalls. Expect open dialogue on governance, data ethics, and the pace of adoption across global markets.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 16:00 - 16:45

Political Violence Roundtable

An expert-led discussion on the rising risks of political violence, unrest and geopolitical disruption. The session will cover underwriting approaches, coverage evolution and claims experience, alongside the implications for reinsurers seeking to balance opportunity with heightened exposure in volatile regions.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 18:00 - 19:30

Sunset Networking

Continue your meetings in an informal setting, to the backdrop of the sunset, on the Royal Terrace.

NETWORKINGWhereAtlantis Royal Terrace

28 APRIL - TUESDAY

- 07:45 - 18:00

REGISTRATION

- 08:00 - 18:30

Meetings

- 09:00 - 09:30

GCC Growth and Reinsurance Opportunities

A deep dive into the Gulf region’s expanding reinsurance ecosystem. Speakers will highlight the latest market developments in Riyadh and Dubai, including the evolving role of brokers, the influx of new capacity and regulatory shifts driving sustainable growth. How is the GCC holding its weight in an age where growth is already well underway?

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom - 09:45 - 10:15

Dubai’s MGA Boom

This session explores the rapid rise of managing general agents in Dubai and across the region. MGA experts will discuss what’s fuelling this growth, how it’s reshaping distribution and where regulatory frameworks and market appetite are headed.

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom - 10:30 - 11:00

Crisis Management in Emerging Markets

A candid discussion with broker and insurer CEOs who have recently established or scaled operations in the region. Topics include political instability and market volatility, amongst others. Strategies for maintaining operational resilience will be at the forefront of this session.

MAIN STAGE - LIGHTNING TALKSWhereAtlantis Ballroom - 12:00 - 12:45

Energy Roundtable – (Onshore and Offshore Gulf Projects)

Industry leaders will explore how the reinsurance market is responding to changing energy dynamics in the Gulf. The discussion spans traditional oil and gas exposures, offshore developments and the transition to green and renewable projects, with insights on capacity and emerging risk management trends.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 13:00 - 13:30

Lunch 1

- 13:30 - 14:00

Lunch 2

- 14:00 - 15:00

Lunch 3

- 15:00 - 15:45

Catastrophe Risk Roundtable – (Flood, Cyclone, Earthquake)

This roundtable brings together experts to discuss how the industry is addressing regional catastrophe exposures. Topics include evolving hazard data, modelling advances and the role of reinsurance in supporting disaster preparedness, rapid recovery and resilient infrastructure across high-risk territories.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 16:00 - 16:45

Cyber Roundtable – (Threat and Claims Environment)

A roundtable assessing the fast-evolving cyber threat landscape and its implications for reinsurance. Participants will examine claims patterns, emerging vulnerabilities, and shifting regulatory requirements, while debating how best to structure risk transfer solutions in an increasingly complex digital environment.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom

29 APRIL - WEDNESDAY

- 07:45 - 16:00

REGISTRATION

- 08:00 - 18:00

Meetings

- 09:00 - 09:45

Türkiye: Growth, Recovery and Risk Transfer

Speakers will address Türkiye’s reinsurance landscape, recent regulatory reforms, post-disaster recovery strategies and the role of international partners in supporting sustainable market development.

MAIN STAGE - GEO SPOTLIGHTWhereAtlantis Ballroom - 10:00 - 10:45

Central Asia: The Next Frontier

This session shines a light on emerging opportunities across Central Asia. Industry participants will examine regional insurance maturity, infrastructure investment and the potential for reinsurance partnerships as economies diversify and expand risk transfer mechanisms.

MAIN STAGE - GEO SPOTLIGHTWhereAtlantis Ballroom - 12:00 - 12:45

Sub-Saharan Africa Roundtable

A dialogue focused on reinsurance market development across Sub-Saharan Africa. Panellists will explore growth in key territories, evolving regulatory frameworks and the role of international partnerships in technology adoption and sustainable market expansion.

CHATHAM HOUSE ROUNDTABLE SESSIONSWhereThe Boardroom - 13:00 - 13:30

Lunch 1

- 13:30 - 14:00

Lunch 2

- 14:00 - 15:00

Lunch 3

Opening Keynotes

Meet our Opening Keynotes

VICTORIA (VICKY) CARTER

Chairman, Global Capital Solutions, International

Victoria (Vicky) Carter is Chairman of Global Capital Solutions, International for Guy Carpenter & Company Ltd. She is a key member of the Guy Carpenter leadership team, responsible for driving new business production across the firm’s global operations and a member of the firm’s Executive Committee.

Vicky is Deputy Chair of Lloyd’s, a Member of the Council of Lloyd’s, the Lloyd’s Remuneration Committee, the Lloyd’s Audit Committee and the Lloyd’s Nominations and Governance Committee. In addition, she is Chairman of the Lloyd’s of London Foundation and Lloyd’s Community Programme and a Trustee of the Sick Children’s Trust. Vicky is a Freeman of the City of London and a Liveryman of The Worshipful Company of Insurers.

Vicky has over 40 years of experience in the reinsurance industry. She was the first female founder of a Lloyd’s intermediary, the first female Deputy Chair of Lloyd’s and has operated in a number of senior executive positions within the broking sector.

ANDREW HORTON

Group Chief Executive Officer

BA Natural Sciences, ACA

Andrew joined QBE as Group Chief Executive Officer in September 2021. He was previously the CEO, and before that the Finance Director, of Beazley Group, a specialist insurer based in the United Kingdom with operations in Europe, the United States and Asia. Prior to this, he held various senior finance roles in ING, NatWest and Lloyds Bank. Andrew has more than 30 years’ experience across insurance and banking, and has extensive experience across international markets.

Our focus for 2024

DWIC, in association with the Dubai International Financial Centre Authority, is celebrating its 20th anniversary with record high attendance in 2024. Those 20 years represent a period during which Dubai’s success on the global stage has transformed the Emirate almost beyond recognition. The risk transfer environment has also changed dramatically within the same time span. In 2024, the re/insurance sector is entering a new era and is presented with one of the most beguiling markets in generations, faced by a web of interconnected challenges and huge opportunities.

Attracting Capital

Reinsurance premium is at new highs after the market reset of 1/1 2023, followed by a profitable year, and a firm 1/1 2024 renewal. New capital continues to flow into the reinsurance industry, across traditional reinsurers as well as the rebounding ILS third party capital market. The DIFC is already seeing an influx of traditional re/insurance capital and broker business, from markets across not just the Middle East, but European markets, emerging African economies, Latin America and Asia Pacific. Traditional reinsurance capital and capital markets, brought together into a regional hub such as the DIFC, can find strong underwriting revenues and profitability in this sector.

The re/insurance sector is looking for further capital to get behind the sector, enjoying the bounties of the new market cycle, with enhanced premium opportunities to deploy capital to great effect. However, the market continues to face uncertainties and outside investors continue to have many options available. Underwriters should continue to showcase quality and discipline to differentiate themselves from the pack, while market-leading hubs such as DIFC continue to demonstrate a state-of-the-art regulatory and operating environment.

Capacity, capacity, capacity

The reinsurance market has cycle has turned and premium volumes have climbed to new levels. Reinsurers want to take advantage of pricing opportunities to grow profitably, looking where to deploy capacity into classes, perils and territories that exhibit strong demand as well as sufficient rate for risks being underwritten. Brokers are bringing new volumes of business to place into the DIFC, and have reported fresh capacity availability globally at the 1/1 reinsurance renewal. However, brokers can still struggle to find sufficient capacity for many of the risks they seek to place. A big question is whether underwriters can rise to this challenge and deploy sufficient capacity, while also exhibiting discipline, looking to maintain their recent gains in rate adequacy and profitability.

Embracing Innovation

Technology has combined with the MGA model to create a revolutionary startup model for the re/insurance industry, significantly reducing the barriers of previous generations of market entrants. Technology-led MGAs are setting up in record numbers, pioneering growth in specialty business, excess and surplus lines, and for emerging and intangible risks. These innovators need the right regulatory environment to incubate and grow, and the DIFC has demonstrated it has the characteristics the market needs, seeing unparalleled MGA growth. Many of the risks being placed by these MGAs are being fed by rich data and analytics, combined with technology rollout, contributing to the digital transformation now in full swing across the commercial insurance and reinsurance sector globally.

Nurturing Artificial Intelligence

The re/insurance market is in the throes of digital transformation. AI promises to change not just the insurance industry, but business and society in myriad ways. Simultaneously a source of incalculable risk and opportunity, a revolutionary driver of operating efficiency and data-driven decision making, and a threat to replace humans with machines – AI is everywhere. What’s clear is that the industry should nurture emerging technological trends in order to take advantage of their opportunities, rather than ignore them and become subject to them, potentially at our peril.

Navigating volatile risks

Insurance markets thrive on risk as opportunity, but the degree of uncertainty and volatility around the globe is also provides a challenging risk environment for re/insurance companies to navigate. Sections of the world have entered a challenging new era of insecurity and instability, presenting heightened insurance risks to the market, and fresh demand for protection for multinationals and their assets, employees and high net worth individuals, using products such as cyber insurance, PV and CPRI. Regional hubs such as Dubai can provide a combination of local expertise and a mature regulatory environment as a base to broker and underwrite products for niche specialty risks, from PV and CPRI.

Talent: the new normal

Competition for talent has never been quiet in the re/insurance world, but demand for re/insurance skills is at an all-time high and ever-changing. The experience and expertise needed for tomorrow are shifting unlike anything ever seen previously due to the transformative role of technology amid the industry’s digital transformation. This has created a new normal for talent. Any conversation about where to find profitable growth will almost inevitably combine the role of underwriting or broking expertise with the role increasingly played by technology insights. These topics are inextricably linked, as increasing use of technology can also allow greater emphasis on core skillsets of relationship building and decision-making at underwriting risk and portfolio levels. The DIFC has been a beacon for talent from across the globe, needed in order for the reinsurance sector to continue grow and serve the world’s risk transfer needs.

-

Hosted by Global Reinsurance, The Dubai World Insurance Congress (DWIC) re-imagines the traditional conference to provide attendees with unrivalled networking, business and thought leadership opportunities, all under one roof.

Published by Global Reinsurance, part of NEWSQUEST MEDIA GROUP LIMITED Limited, registered in England & Wales at Echo Building, 18 Albert Road, Bournemouth, BH1 1BZ. Company Number 01676637. – a Gannett company

-

For sponsorship enquiries contact:

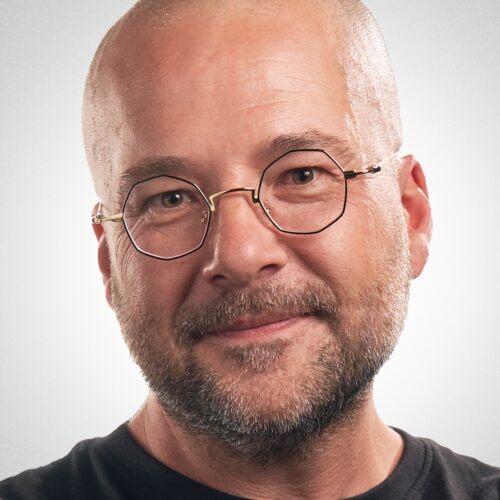

DAN KING

Publishing Director

E: dan.king@nqsm.comFor programme & registration enquiries contact:

DEBBIE KIDMAN

Head of International Operations and Events

E: debbie.kidman@nqsm.com