AGENDA

29 April - Monday

Registration, Opening Plenary, Meeting Hub and Roundtable Sessions- 07:45

REGISTRATION

- 08:00 - 18:00

MEETING HUB

10:00 - 10:05

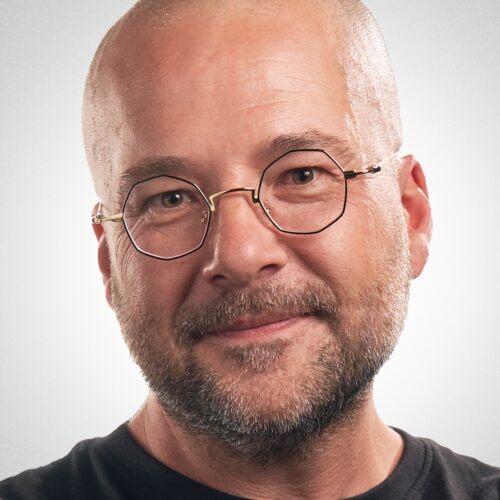

10:00 - 10:05WELCOME FROM THE CONFERENCE CHAIR

By DAVID BENYON Editor, Global Reinsurance & DWIC Conference Chair 10:05 - 10:15

10:05 - 10:15OPENING ADDRESS 2024

By ALYA AL ZAROUNI Chief Operating Officer, Dubai International Financial Centre Authority 10:15 - 10:45

10:15 - 10:45INTERNATIONAL KEYNOTE 2024

By VICKY CARTER Vicky Carter, Chairman, Global Capital Solutions, International, Guy CarpenterFinding clarity in chaos: from uncertainty to opportunity

The re/insurance industry is at a pivotal moment: economic, technological, political and environmental shifts represent significant challenges; the interconnected global ecosystem simultaneously represents enormous emerging opportunities. How the industry responds, including through collaboration, innovation and adaptation, will be crucial.

• Understanding the regional risk landscape

• Challenges faced in the global risk outlook

• Innovative responses – cyber & AI, geopolitics, collaborationMain Stage SessionWhereSpice Ballroom 10:45 - 11:15

10:45 - 11:15INTERNATIONAL KEYNOTE 2024

By ANDREW HORTON Andrew Horton, Group Chief Executive Officer, QBEImportance of consistency and innovation in insurance

Insurance is essential to our economic prosperity and growth and is becoming increasingly relevant as we navigate an ever-changing and uncertain world. Now more than ever before, consistency and innovation are the twin engines that propel this industry forward.

• Insurance in an uncertain world – increasing relevance

• Why consistency matters

• Why innovation matters

• The non-negotiable investmentsMain Stage SessionWhereSpice Ballroom

11:15 - 12:00

11:15 - 12:00VIEW FROM THE TOP 2024

By LAURENT LEMAIRE Founder and CEO, Elseco, GRACITA AOA-DE GRACIA Assistant Vice President – Insurance & Reinsurance, Dubai International Financial Centre Authority, FARID CHEDID Chairman, Chedid Capital Group, CHRIS MACKINNON Deputy Regional Director, Asia Pacific Middle East & Africa, Lloyd's, VICKY CARTER Vicky Carter, Chairman, Global Capital Solutions, International, Guy CarpenterThe reinsurance market in 2024 is perhaps the most bracing in the sector’s history. Reinsurers have strong reasons to be bullish after a firm 1/1 that built on last year’s heady premium gains. But as the market courts admirers among would-be investors, and capacity looks to deploy into areas of attractive rate, old hands in the market are closely watching a range of interconnected risks and challenges, from embracing innovation and fostering talent, to an unpredictable risk outlook and fast-emerging technologies. The panel debate will focus on how the industry can address the challenges and shape them from risks into opportunities.

Discussion points:

1. Attracting Investment

2. Capacity, capacity, capacity

3. Embracing Innovation

4. Nurturing Artificial Intelligence

5. Navigating risks

6. Fostering talentMain Stage SessionWhereSpice Ballroom- 13:00 - 15:00

NETWORKING LUNCH

14:00 - 15:00

14:00 - 15:00Roundtable | MGAS: CATALYST FOR GROWTH AND INNOVATION

By GRACITA AOA-DE GRACIA Assistant Vice President – Insurance & Reinsurance, Dubai International Financial Centre AuthorityMGAS - CATALYST FOR GROWTH AND INNOVATION

In today's dynamic insurance industry, Managing General Agents (MGAs) have emerged as key catalysts for growth and innovation, reshaping the traditional distribution model and driving efficiency in underwriting and product development. In this roundtable, DIFC will bring together industry experts, thought leaders, regulators, and practitioners to share insights, best practices, and innovative solutions for unleashing the full potential of MGAs as catalysts of growth and innovation in the insurance industry.

•State of MGAs/Rise of MGAs: How MGAs are disrupting the insurance market by providing expertise, efficient distribution channels, and tailored solutions to meet the evolving needs of customers.

•Innovation: How MGAs are leveraging data analytics, technology, and market insights to develop innovative insurance products and streamline the underwriting process.

•Opportunities: What are the growth opportunities presented by MGAs for reinsurers and other industry stakeholders through enhanced market access and product diversification?

•Challenges and regulatory landscape: What are the regulatory challenges facing MGAs, i.e.: licensing requirements, compliance standards, and governance issues.

•Partnerships: The importance of collaboration between MGAs, reinsurers, and InsurTech firms to foster a culture of innovation, drive operational efficiencies, and provide unique customer experiences.

•Outlook: What are the future trends shaping the MGA landscape? I.e. InsurTech , data privacy concerns and the evolving customer preferences. How can MGAs adapt and thrive in this fast-paced environment?PARTICIPANTS

OWAIS ANSARI, CEO, MUNICH RE DIFC

WAEL MOHSEN, MANAGING DIRECTOR- MENA, OPTIO RE MENA

NICK CHARTERIS-BLACK, MANAGING DIRECTOR- MARKET DEVELOPMENT, EMEA, AM BEST

NADIM SEMAAN, SEO, GALLAGHER

DENIS TUR, CHIEF PROPERTY AND ENGINEERING UNDERWRITER, ALIF MGA

RAHUL MISRA, SEO, GR RISK PARTNERS

Roundtable SessionsWhereThe BoardroomHosted by Protection Re

PROPERTY IN FOCUS

The Middle East is in the midst of yet another transformational construction boom, driven out of Saudi Arabia in the main, which will result in an increase in Property risks , put simply it cannot happen without being underwritten by a significant rise in premium for the Property Class. Certain countries in other regions in Asia and Africa are witnessing the same , as economies strive to put the effects of the Pandemic and associated economic impacts behind them. An increased volume of new and existing (by default ) commercial, residential property, hospitality and tourism, energy and infrastructure will come to market, presenting opportunities for local and international re/insurance markets. Is the re/insurance industry ready to play its part?

• Opportunity: a new property boom for re/insurers ( when, and in what class )

• Risk: Resilience, standards and smarter buildings ( impact on underwriting philosophies )

• Capacity availability, supply and demand ( opportunity or hurdle )

• Hub markets and attracting international capital ( how do we attract hub market capacity to regionalized risk )

PARTICIPANTS

SUPRIYA SEHGAL, DIRECTOR, REINSURANCE, PROTECTION RE

STEVE WILSON, BUSINESS DEVELOPMENT, REINSURANCE, PROTECTION RE

FARZANA CHOWDHURY, MANAGING DIRECTOR & CEO, GREEN DELTA INSURANCE CO.

SUDYUMNA PRASAD UPADHYAYA, CHIEF EXECUTIVE OFFICER, SANIMA GIC INSURANCE

MUHAMMAD AMINUDDIN, CEO, TPL INSURANCE

SHADAB KHAN, HEAD OF REINSURANCE, TPL INSURANCE

LETY EPOSI ENDELEY, CENTRAL DIRECTOR, NON-LIFE, CICA-RE

LAKSHITHA FERNANDO, ASSISTANT GENERAL MANAGER REINSURANCE, SOLARELLE INSURANCE

ROMULO DELOS REYES, PRESIDENT & GENERAL MANAGER, STRONGHOLD INSURANCE COMPANY

Roundtable SessionsWhereThe Boardroom- 18:00 - 20:00

OFFICIAL DWIC WELCOME DRINKS RECEPTION hosted by Manoj Re

30 April - Tuesday

Registration, Meeting Hub and Roundtable Sessions- 07:45

REGISTRATION

- 08:00 - 18:00

MEETING HUB

10:00 - 11:00

10:00 - 11:00DRAGONS' DEN HOSTED BY LLOYD'S LAB

By MOHAMED SHARAF Chief Operating Officer for Investment Attraction Dubai Economic Development Corporation, STEPHEN GOTZ Head of Business, DIFC Innovation Hub, ROSIE DENÉE Senior Manager, Lloyd’s Lab , CHRIS MACKINNON Deputy Regional Director, Asia Pacific Middle East & Africa, Lloyd's, VICKY CARTER Vicky Carter, Chairman, Global Capital Solutions, International, Guy CarpenterLloyd's - 5in5 Pitches

CYNTEGRA

Presenter: Maria Vachino, Co Founder

Cyntegra’s patented Recovery Operating System enables organizations to avoid the potentially catastrophic disruption and associated costs of ransomware and disruptive malware attacks by enabling end users to fully restore a compromised system to its familiar and functional preattack state in minutes.AQUINSURE

Presenter: Eric Li, Chief Executive

Aquinsure is an innovative aquacultural technology company with the vision of improving aquacultural efficiency and sustainability and the initial team of the company is a joint group of acoustic researchers, aquacultural experts and insurance actuaries. They utilise sonar to provide parametric insurance policies.PHINSEYS

Presenter: Stuart Conibear, Commercial Director

Phinsys has built a platform of software tools to optimise and automate the finance function of insurance businesses, improving their financial accounting, regulatory reporting and analytical processes. The company works with a wide range of insurance organisations across the UK, Europe, US, Bermuda, and Lloyd’s insurance markets.LORO

Presenter: Peter Tilbrook, CEO

Loro’s platform enables insurers or MGAs to quickly create, customize, and deploy specialty insurance products without any upfront investment. Additionally, Loro's solution is completely free for the first $100,000 GWP every year, providing unmatched accessibility and affordability.SUPERCEDE

Presenter: Tom Spier, Head of Commercial

Supercede is an e-trading and ecosystem platform built to support the facilitation of any reinsurance deal. Supercede works across the reinsurance value chain, offering services to cedents, brokers and reinsurers. It helps cedents with data preparation, connects brokers with a global network of reinsurance underwriters, and offers reinsurers the ability to search for risks that map their appetite.Main Stage SessionWhereSpice Ballroom

11:15 - 12:15

11:15 - 12:15TÜRKIYE INSURANCE MARKET OUTLOOK AND OPPORTUNITIES

By PHIL STORY SEO, ITA (MIDDLE EAST) AND Chairman, DIFC Insurance Association, CENK ECEVIT Owner, ECB Insurance Brokers and Chairman, Türkiye Insurance Brokers Association, UGUR GULLEN CEO, AK Sigorta Insurance Company and Chairman, Türkiye Insurers And Reinsurers Association, ATINC YILMAZ Regional CEO, Howden Türkiye & Central Asia Board Member Of Türkiye Insurance Brokers AssociationThe session will provide a comprehensive analysis of the current state and future prospects of the insurance industry in Turkiye. Panelists will discuss key trends, and emerging opportunities within the market. Attendees will gain insights into potential growth areas, challenges, and strategies for navigating the evolving landscape. The symposium serves as a platform for industry stakeholders to exchange ideas, foster collaboration, and drive innovation within the Turkish insurance sector.

•Current market status, GWP growth and future growth potentials

•Earthquake risks and Turkiye’s experience post Maras earthquake and lessons learned

•Emerging trends and new customer preferences

•Distribution channels and increasing role of brokers in an agency dominated market

•Global market integration of Turkiye and reinsurance capacity requirements in order to sustain the fast growthMain Stage SessionWhereMain Stage 12:30 - 13:30

12:30 - 13:30Roundtable | POLITICAL VIOLENCE: NAVIGATING NEW RISKS

By DAVID BENYON Editor, Global Reinsurance & DWIC Conference ChairPOLITICAL VIOLENCE: NAVIGATING NEW RISKS

The Political Violence (PV) market is a fast-growing specialty business driven by geopolitical risk volatility. Loss events and tensions around the globe have put pressure on existing products (e.g. SRCC) and spurred standalone PV growth. From its market origins within terrorism and war risk teams, PV has become a major growth line for specialty brokers and underwriters active in many emerging markets, including Middle East and African countries, that in the current era of global insecurity, could become the next PV hotspot. This roundtable focuses on:

•MENA and SSA regional growth markets for PV

•Meeting client demand with fit-for-purpose products

•Skills focus: key broking and underwriting expertise

•A maturing market: what next for the PV market?

PARTICIPANTS

SAMAR HAIDAMOUS, EXECUTIVE DIRECTOR, UIB

MICHEL DARCY, MANAGING PARTNER, COPE REINSURANCE BROKERS

GREG CARTER, MANAGING DIRECTOR, ANALYTICS EMEA & AP, AM BEST

SANDEEP MAHAJAN, HEAD OF FACULTATIVE, JB BODA REINSURANCE BROKERS

WADIH HARDINI, GENERAL MANAGER- HEAD OF FACULTATIVE/GLOBAL OPERATIONS, CHEDID RE

RAFIC ABI-SALEH , ASSISTANT VICE PRESIDENT- WAR & TERRORISM, LIBERTY SPECIALTY MARKETS MENA

SAMUEL CAULTON-POYNDER, POLITICAL VIOLENCE AND TERRORISM UNDERWRITER, THE FIDELIS PARTNERSHIP

RISHI THAPAR, SENIOR CLIENT MANAGER, VP, LOCKTON MENA

ZOUHEB AZAM, SENIOR EXECUTIVE OFFICER, ASR MIDDLE EAST

GEORGES AL BITAR, CEO, PREMIUM FRANCE SARL

ZUHAIR REDHA, POLITICAL VIOLENCE UNDERWRITER, IGI - INTERNATIONAL GENERAL INSURANCE

Roundtable Sessions- 13:00 - 15:00

NETWORKING LUNCH

14:00 - 15:00

14:00 - 15:00Roundtable | TAKAFUL & RETAKAFUL...RESURRECTION

By MOHAMED SAAD FCII-Chartered Insurer, SEO, Africa Re DIFCCHAKIB ABOUZAID, SECRETARY GENERAL, GENERAL ARAB INSURANCE FEDERATION (GAIF)

REHMAN SAEED, VICE PRESIDENT - BUSINESS DEVELOPMENT, NASCO FRANCE

VASILIS KATSIPIS, GENERAL MANAGER, AM BEST

MOHAMMED ALI LONDE, VICE PRESIDENT - SENIOR ANALYST, MOODY'S RATINGS

SUZAN PARDESI, HEAD OF ENERGY, AFRICA SPECIALTY RISKS

HANY HELMY, SENIOR MANAGER, INSURANCE SUPERVISION, DFSA

GAUTAM DATTA, CEO, NATIONAL TAKAFUL COMPANY- WATANIA

WALTER JOPP, CEO, SALAMA ISLAMIC INSURANCE COMPANY

MOHAMMAD MAHBOOB KHAN, CEO, JENOA

Roundtable SessionsWhereThe Boardroom 15:00 - 16:00

15:00 - 16:00Roundtable | HEALTH INSURER OF THE FUTURE: FOCUS ON KEY TRENDS

By SARA BENWELL Editor, StrategicRISKPARTICIPANTS

LAURENT POCHAT COTTILLOUX, CHIEF EXECUTIVE OFFICER, AXA LIFE & HEALTH REINSURANCE SOLUTIONS

SIMON PRICE, HEAD OF FAMILY & HEALTH TAKAFUL, SALAMA

MICHAEL WALSH, SALES DIRECTOR, DEMOCRANCE

MAZEN ABOUCHAKRA , REGIONAL DIRECTOR- MENA & EAST MEDITERRANEAN, GEN RE

DR. ABDUL ZAHRA A. ALI AL TURKI, CEO, NATIONAL GENERAL INSURANCE COMPANY

SHUKRI ABOU JAOUDE, SENIOR DIRECTOR MEDICAL & LIFE, CHEDID RE

MONA HAMMAD, ASSISTANT PROFESSOR, AMERICAN UNIVERSITY IN THE EMIRATES

ATINC YILMAZ , HOWDEN EUROPE REGIONAL CEO- TURKEY & CENTRAL ASIA, HOWDEN

FARZANA CHOWDHURY, MANAGING DIRECTOR & CEO, GREEN DELTA INSURANCE CO.

PETER SAMY, REGIONAL SALES DIRECTOR, UNITED HEALTHCARE

ARVIND KASHYAPA, CEO, NEWTECH INSURANCE

Roundtable SessionsWhereThe Boardroom

Opening Keynotes

Meet our Opening Keynotes

VICTORIA (VICKY) CARTER

Chairman, Global Capital Solutions, International

Victoria (Vicky) Carter is Chairman of Global Capital Solutions, International for Guy Carpenter & Company Ltd. She is a key member of the Guy Carpenter leadership team, responsible for driving new business production across the firm’s global operations and a member of the firm’s Executive Committee.

Vicky is Deputy Chair of Lloyd’s, a Member of the Council of Lloyd’s, the Lloyd’s Remuneration Committee, the Lloyd’s Audit Committee and the Lloyd’s Nominations and Governance Committee. In addition, she is Chairman of the Lloyd’s of London Foundation and Lloyd’s Community Programme and a Trustee of the Sick Children’s Trust. Vicky is a Freeman of the City of London and a Liveryman of The Worshipful Company of Insurers.

Vicky has over 40 years of experience in the reinsurance industry. She was the first female founder of a Lloyd’s intermediary, the first female Deputy Chair of Lloyd’s and has operated in a number of senior executive positions within the broking sector.

ANDREW HORTON

Group Chief Executive Officer

BA Natural Sciences, ACA

Andrew joined QBE as Group Chief Executive Officer in September 2021. He was previously the CEO, and before that the Finance Director, of Beazley Group, a specialist insurer based in the United Kingdom with operations in Europe, the United States and Asia. Prior to this, he held various senior finance roles in ING, NatWest and Lloyds Bank. Andrew has more than 30 years’ experience across insurance and banking, and has extensive experience across international markets.

Our focus for 2024

DWIC, in association with the Dubai International Financial Centre Authority, is celebrating its 20th anniversary with record high attendance in 2024. Those 20 years represent a period during which Dubai’s success on the global stage has transformed the Emirate almost beyond recognition. The risk transfer environment has also changed dramatically within the same time span. In 2024, the re/insurance sector is entering a new era and is presented with one of the most beguiling markets in generations, faced by a web of interconnected challenges and huge opportunities.

Attracting Capital

Reinsurance premium is at new highs after the market reset of 1/1 2023, followed by a profitable year, and a firm 1/1 2024 renewal. New capital continues to flow into the reinsurance industry, across traditional reinsurers as well as the rebounding ILS third party capital market. The DIFC is already seeing an influx of traditional re/insurance capital and broker business, from markets across not just the Middle East, but European markets, emerging African economies, Latin America and Asia Pacific. Traditional reinsurance capital and capital markets, brought together into a regional hub such as the DIFC, can find strong underwriting revenues and profitability in this sector.

The re/insurance sector is looking for further capital to get behind the sector, enjoying the bounties of the new market cycle, with enhanced premium opportunities to deploy capital to great effect. However, the market continues to face uncertainties and outside investors continue to have many options available. Underwriters should continue to showcase quality and discipline to differentiate themselves from the pack, while market-leading hubs such as DIFC continue to demonstrate a state-of-the-art regulatory and operating environment.

Capacity, capacity, capacity

The reinsurance market has cycle has turned and premium volumes have climbed to new levels. Reinsurers want to take advantage of pricing opportunities to grow profitably, looking where to deploy capacity into classes, perils and territories that exhibit strong demand as well as sufficient rate for risks being underwritten. Brokers are bringing new volumes of business to place into the DIFC, and have reported fresh capacity availability globally at the 1/1 reinsurance renewal. However, brokers can still struggle to find sufficient capacity for many of the risks they seek to place. A big question is whether underwriters can rise to this challenge and deploy sufficient capacity, while also exhibiting discipline, looking to maintain their recent gains in rate adequacy and profitability.

Embracing Innovation

Technology has combined with the MGA model to create a revolutionary startup model for the re/insurance industry, significantly reducing the barriers of previous generations of market entrants. Technology-led MGAs are setting up in record numbers, pioneering growth in specialty business, excess and surplus lines, and for emerging and intangible risks. These innovators need the right regulatory environment to incubate and grow, and the DIFC has demonstrated it has the characteristics the market needs, seeing unparalleled MGA growth. Many of the risks being placed by these MGAs are being fed by rich data and analytics, combined with technology rollout, contributing to the digital transformation now in full swing across the commercial insurance and reinsurance sector globally.

Nurturing Artificial Intelligence

The re/insurance market is in the throes of digital transformation. AI promises to change not just the insurance industry, but business and society in myriad ways. Simultaneously a source of incalculable risk and opportunity, a revolutionary driver of operating efficiency and data-driven decision making, and a threat to replace humans with machines – AI is everywhere. What’s clear is that the industry should nurture emerging technological trends in order to take advantage of their opportunities, rather than ignore them and become subject to them, potentially at our peril.

Navigating volatile risks

Insurance markets thrive on risk as opportunity, but the degree of uncertainty and volatility around the globe is also provides a challenging risk environment for re/insurance companies to navigate. Sections of the world have entered a challenging new era of insecurity and instability, presenting heightened insurance risks to the market, and fresh demand for protection for multinationals and their assets, employees and high net worth individuals, using products such as cyber insurance, PV and CPRI. Regional hubs such as Dubai can provide a combination of local expertise and a mature regulatory environment as a base to broker and underwrite products for niche specialty risks, from PV and CPRI.

Embracing Innovation

Technology has combined with the MGA model to create a revolutionary startup model for the re/insurance industry, significantly reducing the barriers of previous generations of market entrants. Technology-led MGAs are setting up in record numbers, pioneering growth in specialty business, excess and surplus lines, and for emerging and intangible risks. These innovators need the right regulatory environment to incubate and grow, and the DIFC has demonstrated it has the characteristics the market needs, seeing unparalleled MGA growth. Many of the risks being placed by these MGAs are being fed by rich data and analytics, combined with technology rollout, contributing to the digital transformation now in full swing across the commercial insurance and reinsurance sector globally.

Talent: the new normal

Competition for talent has never been quiet in the re/insurance world, but demand for re/insurance skills is at an all-time high and ever-changing. The experience and expertise needed for tomorrow are shifting unlike anything ever seen previously due to the transformative role of technology amid the industry’s digital transformation. This has created a new normal for talent. Any conversation about where to find profitable growth will almost inevitably combine the role of underwriting or broking expertise with the role increasingly played by technology insights. These topics are inextricably linked, as increasing use of technology can also allow greater emphasis on core skillsets of relationship building and decision-making at underwriting risk and portfolio levels. The DIFC has been a beacon for talent from across the globe, needed in order for the reinsurance sector to continue grow and serve the world’s risk transfer needs.

-

Hosted by Global Reinsurance, The Dubai World Insurance Congress (DWIC) re-imagines the traditional conference to provide attendees with unrivalled networking, business and thought leadership opportunities, all under one roof.

Published by Newsquest Specialist Media Limited, registered in England & Wales with number 02231405 at Loudwater Mill, Station Road, High Wycombe HP10 9TY – a Gannett company

-

For sponsorship enquiries contact:

DAN KING

Publishing Director

E: dan.king@nqsm.comFor programme & registration enquiries contact:

DEBBIE KIDMAN

Head of International Operations and Events

E: debbie.kidman@nqsm.com